Dive Brief:

- Amphenol Corp. had to replace HVAC filters and treat surfaces with a special cleaner because of the physical presence of the Covid virus in its manufacturing facility, but that wasn’t enough to show the virus caused physical damage to the property, a federal district court ruled.

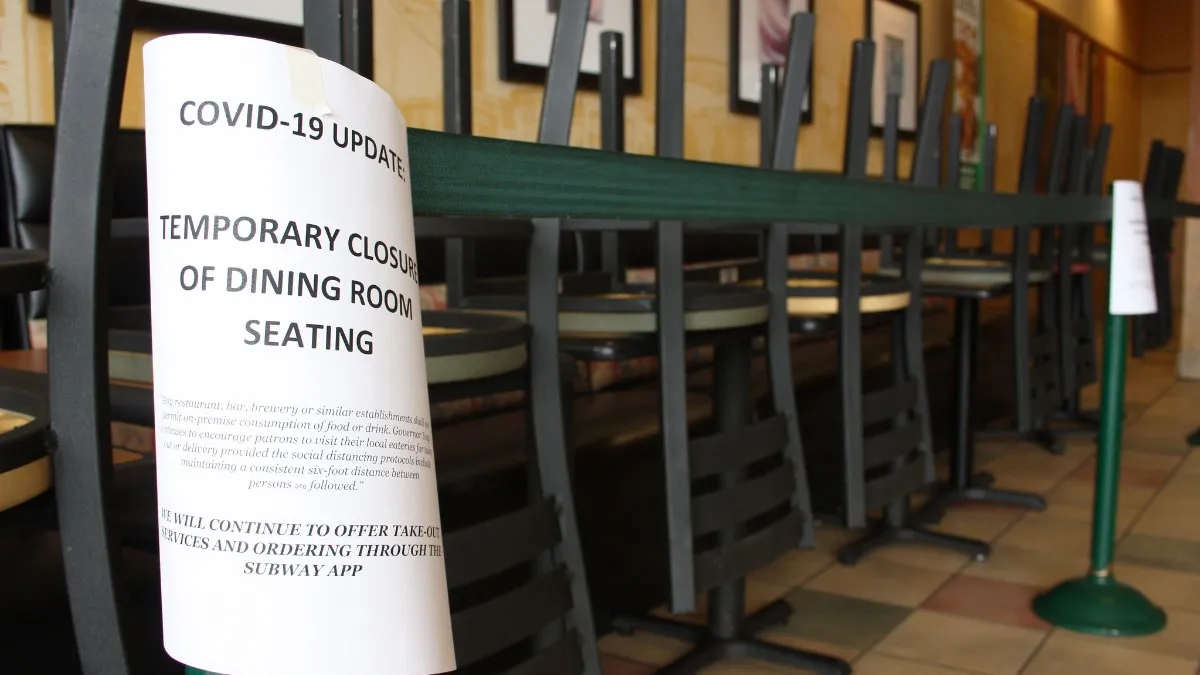

- In the latest in a long line of similar lawsuits coming out of the pandemic, the company was seeking payment of its business interruption insurance by Factory Mutual Insurance Company. But, as in other cases, the insurer prevailed on the grounds that the loss of business wasn’t due to physical damage caused by the virus.

- “Plaintiff attempts to couch its pleading as appreciably different from others that have been dismissed, but the court disagrees,” Judge Omar Williams of the U.S. District Court for the District of Connecticut said in the April 24 ruling.

Dive Insight:

The electrical and fiber optic manufacturer said it lost $100 million in the pandemic, and although its policy excluded business interruption through contamination and the loss of its use of the property, the company said it was owed money for loss due to physical damage to its property.

“Recent discoveries show the virus capable of bonding to and absorbing into surfaces, allowing those surfaces to transmit the virus through contact, thus rendering the facilities housing such surfaces unfit for intended use,” the company argued, according to the ruling. “This qualifies as structural alteration sufficient to satisfy the Policy. [What’s more,] adjustments to facility layouts and replacing HVAC filters and units [qualify as damage].”

But the Connecticut Supreme Court has already found that business income losses and retrofitting costs don’t qualify as physical loss or damage, the court ruled.

Nor did the plaintiff in a similar Second Circuit case show how the presence of virus-transmitting particles tangibly altered or impacted the property, the judge said.

In that other case, it wasn’t the pandemic’s effect on the physical structure that rendered the building uninhabitable or dangerous; it was people gathering in the space that did.

“Although Plaintiff clearly has attempted to plead around these rulings by alleging damage and consequential repairs, the only ‘damage’ the complaint specifically describes is the presence of viral particles on surfaces, and the only ‘repairs’ described are the cleaning (specialized as it was) of Amphenol facilities, the installation of additional barriers and workspaces, and the replacement of HVAC units and filters,” the court said.

One win among losses

There has been at least one case in which a policy holder successfully made the physical-damage argument in court.

Baylor College of Medicine in a Texas district court last year prevailed using the argument over underwriters in a Lloyd’s of London syndicate. But the set of facts in the case were unique, analysts say. Among other things, Baylor continued to treat patients and conduct pandemic-related clinical trials throughout the pandemic.

By continuing to have people come into the facility, said Murray Fogler, an attorney with Fogler, Brar, O’Neil & Gray who represented the medical college, “we were able to prove the virus was there, which made us different than restaurants or hair salons or any other, because the property was repeatedly re-infected with the virus every day.”

But that line of argument isn’t showing up in other courts to help companies like Amphenol prevail in their efforts.

“I’d hope that some of the courts would permit these [Covid insurance] claims to go to a jury in their jurisdictions,” Fogler said in a Bloomberg Law report. “There are still many of them out there.”

One other case, that made it through the Louisiana Fourth Circuit Court of Appeals, ended up getting reversed by the Louisiana Supreme Court. That case involved a restaurant company that closed during the pandemic.