The Department of Justice’s big antitrust win last month blocking the merger of Penguin Random House and Simon & Schuster hinged on its ability to show authors were likely to see their advances drop because an already highly concentrated market among book publishers was only going to get more concentrated.

“The defendants presented [no] admissible evidence of efficiencies or any other evidence that changes the Court’s view of the competitive landscape,” federal judge Florence Pan of the U.S. District Court for the District of Columbia said in her decision. “The Court finds that the proposed merger … violates Section 7 of the Clayton Act because it is likely to substantially lessen competition in the market for the publishing rights to anticipated top-selling books.”

The text of the October 31 ruling wasn't released until November 7 to give parties a chance to agree on redactions.

The ruling, which focuses on labor-market harm rather than the more usual consumer harm, marked one of the federal government’s biggest wins since President Biden early in his term announced his intent to make antitrust enforcement a focus of his administration.

“It is the policy of my Administration to enforce the antitrust laws to combat the excessive concentration of industry, the abuses of market power, and the harmful effects of monopoly and monopsony — especially as these issues arise in labor markets,” Biden said in July 2021.

Practical indicia of a market

Attorneys for the book publishers, the first and third largest publishers in the United States, argued the federal government had invented a market – anticipated top sellers – solely for the purpose of going after their clients and that the $250,000 author advance the government used to define the market was random.

But Pan said DOJ appropriately identified such a market and that the focus on the $250,000 was beside the point.

“The threshold number need not represent an exact point at which the market begins to distinguish a product,” she said.

Had DOJ used $500,000 or $1 million, the result would have been the same.

“The defendants’ excessive concern over the specific dollar threshold betrays a misunderstanding of why the threshold was chosen,” Pan said. “The $250,000 was adopted only as an analytical tool.”

Market concentration

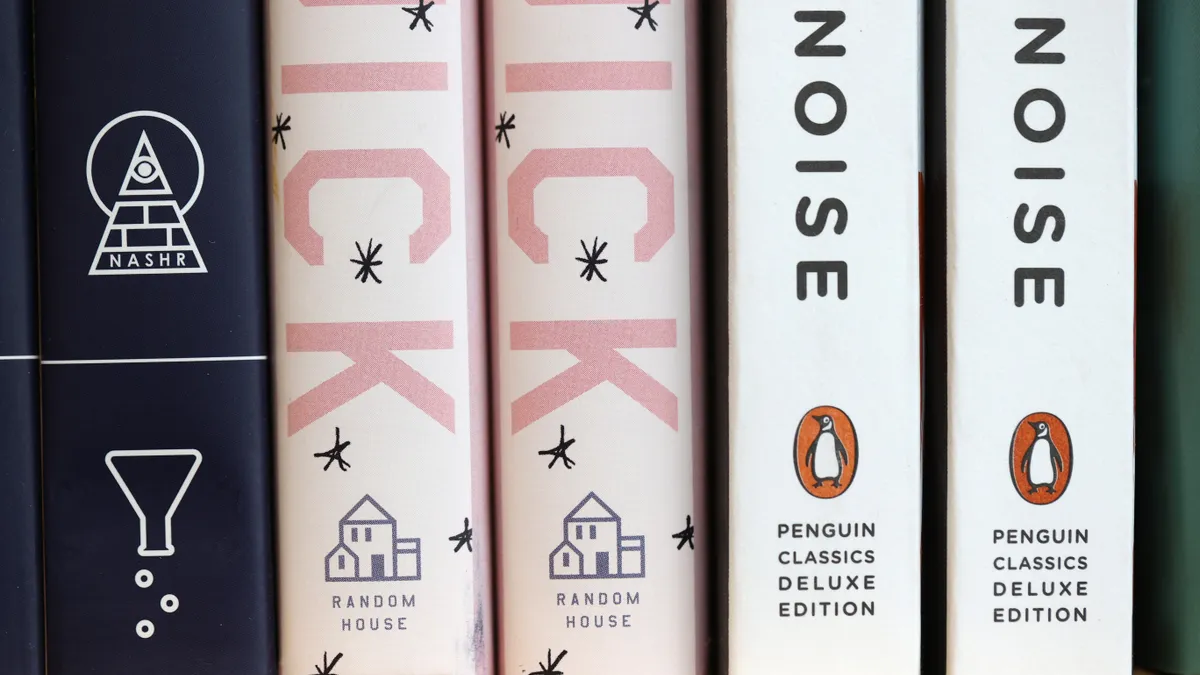

Penguin Random House and Simon & Schuster, along with the other publishers that comprise the country’s five largest publishers, compete fiercely for the publishing rights to anticipated top sellers because while this market segment accounts for only 2% of books published, the segment generates 70% of sales each year.

The so-called Big 5 control 91% of this market because smaller publishers lack the resources to compete; not only are the advances high but agents expect publishers to offer up a lot of resources for marketing and distribution –$40,000 to $90,000 per title compared to $10,000 for other titles.

“Authors know that ‘when a publisher really gets behind a book, particularly a big publisher, the chances are that that book is probably going to succeed on some level,’” said Pan, referencing a past case.

For that reason, although smaller publishers occasionally win the rights to these books, their 9% market share is too little, and spread among too many publishers, to provide a competitive counterweight to a combined Penguin Random House-Simon & Schuster, which together would command 49% of the market.

Pan took issue with defense attorneys’ effort to treat these smaller publishers and their 9% market share as a combined entity, as if they as a group represented a sixth company to compete against the Big 5.

“The defendants take the novel approach of aggregating all the non-Big 5 publishers and characterizing them as a single force with a 9-percent market share,” she said. “The defendants offer no precedent to support this economic sleight of hand.”

Pan also responded skeptically to the publishers’ argument there was little reason to think the combined company would drive down author advances.

Given the history of the Big 5 working in concert with one another, the combined company would have little incentive to do anything but leverage the market advantage the merger would give it.

“The Big 5 are already engaging in tacit collusion or parallel accommodating conduct when acquiring books,” said Pan, pointing to the way publishers over the years have stopped negotiating certain contract terms with agents and instead have agreed to act as if the terms have been standardized.

“Advances used to be paid to authors in two installments, but publishers uniformly moved to paying them in three installments and then four installments,” she said. “After audio books became a significant source of revenue in the industry, publishers uniformly refused to acquire books without audio rights included, thereby limiting authors’ ability to maximize their compensation.”

Similarly with e-books. When these became popular, publishers rammed through a drop in royalty rates from 50% to 25%.

In short, working in coordination with one another, publishers forced the standardization of contract terms, leaving only the author advance as the main focus of competition.

“In an industry where the competition to acquire anticipated top sellers is intense, the competing publishers nevertheless choose, almost always, not to gain advantage by offering more favorable contract terms,” she said.

In other words, given that the market is “already prone to collusion, where coordinated conduct already appears to be rampant,” the merger would “reinforce the market’s oligopsonistic structure and create a behemoth industry leader that other market participants could easily follow,” she said. “The merger would thus increase the market’s already high susceptibility to coordination.”

The publishers have said they plan to appeal the decision.