A restaurant company this week notched a rare business interruption insurance win when the Louisiana Fourth Circuit Court of Appeal, in a 3-2 decision, called it ambiguous whether the company’s all-risks policy limiting coverage to physical loss or damage applies to COVID-19 contamination.

“The insurance policy is … capable of more than one reasonable interpretation in regards to the coverage of lost business income,” Chief Judge Terri Love said in the majority opinion in Cajun Conti v. Certain Underwriters at Lloyd's, London, reversing the trial court decision.

The win cuts against the tide and could open the door to more courts finding in favor of companies trying to get insurance companies to pay business interruption claims as a result of government lockdowns.

"While the matter is not over yet, today's decision was vindication for the effort that was undertaken to have the insurance companies provide coverage when there is no virus exclusion in the policy," Daniel Davillier of Davillier Law Group, co-counsel for the restaurant company, said in a Law360 report.

Insurer-friendly decisions

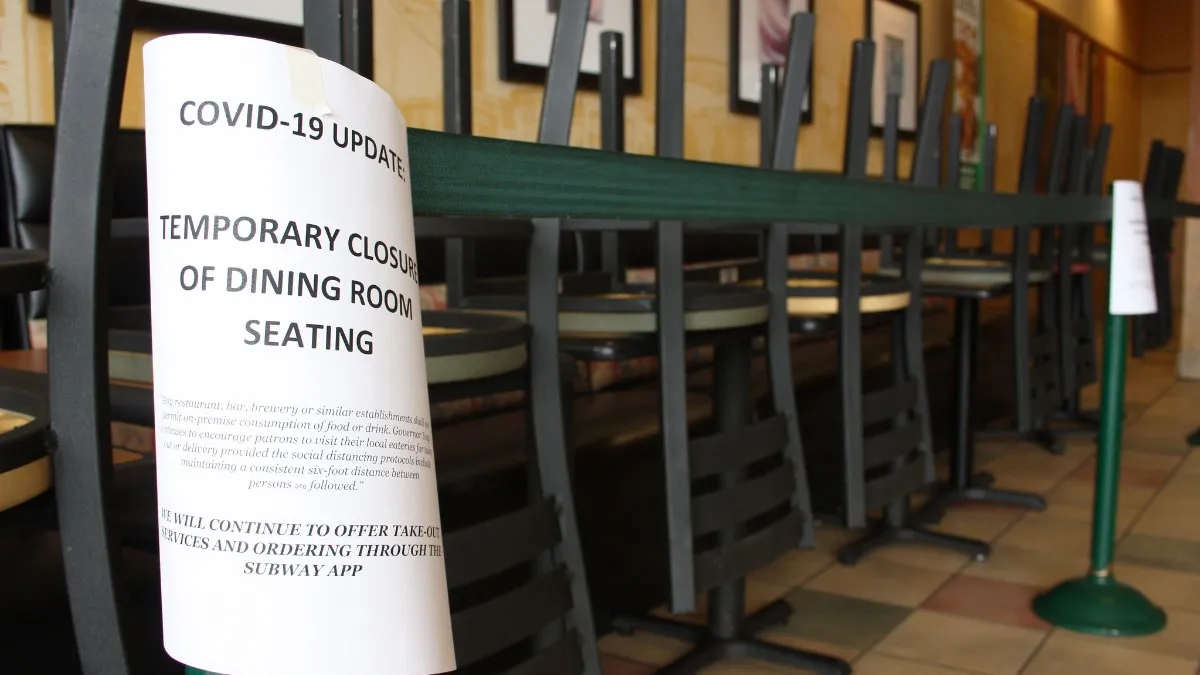

The vast majority of business interruption policies exclude virus outbreaks from coverage, so there’s no issue in these cases, but thousands of companies have policies that don’t single out viruses, and these are the ones trying to take on insurance carriers.

Up to this point, courts have overwhelmingly sided with insurers that only physical loss or damage, like that caused by a flood or a fire, can trigger coverage, according to a litigation tracker by the University of Pennsylvania and the Insurance Law Center.

That’s in line with claims by insurance companies that these policies were never intended for something like COVID.

“Pandemic outbreaks are uninsured because they are uninsurable,” David Sampson, president of the American Property Casualty Insurance Association (APCIA), has said.

Two recent wins by insurers are typical of the way these cases have been going. The state supreme courts in Iowa and Massachusetts have said contract terms are clear about the need for physical loss or damage.

“If an insurance policy and its exclusions are clear, the court ‘will not “write a new contract of insurance”’ for the parties,” the Iowa court said, citing previous rulings.

Not so clear

The Louisiana decision suggests courts might be reaching that conclusion too quickly.

The case looks at the loss of business by the company that owns the Oceana Grill in New Orleans. The judge says the exclusions aren’t clear because the virus, like asbestos or carbon monoxide or even an odor, has a physical presence even if it can’t be seen with the naked eye.

“The appellants demonstrated that contagion-causing viral particles persisted in the air of the premises,” Love wrote in the decision. “Under the facts of this viral contagion case, an equal level of clarity [about physical damage] is absent.”

In her concurring statement, Judge Joy Cossich Lobrano said the decision was bound by a 2011 lead-contamination decision by the court, Widder v. Louisiana Citizens Prop. Ins., that ruled physical damage isn't needed to trigger coverage if the property is made unusable or uninhabitable.

In his dissent, Judge Roland Belsome said the policy language is clear that any benefits would be paid when the property is being restored as a result of physical damage, something that doesn’t apply to Oceana. Among other things, he said, “Oceana had employees, vendors, and eventually a limited number of patrons on site, which defeats the contention that the property was uninhabitable and useless.”

Although it’s just one win and this and other cases face additional hurdles, the positive result for the restaurant company holds out the promise other appellate courts will follow suit and “employ a deeper consideration of the words that insurers have chosen,” Michael Levine of Hunton Andrews Kurth said in the Law360 report.