Baylor College of Medicine’s big win against underwriters in a Lloyd’s of London syndicate for denying a claim against its business interruption insurance for COVID-19-related losses could have applicability outside the unique facts of its case.

Unlike most organizations that have sued insurers for not paying claims after the pandemic forced them to close or curtail their operations, Baylor stayed open to treat patients and conduct pandemic-related clinical trials, among other things.

By continuing its operations, it was able to show that the virus is, in fact, something that can cause direct physical damage to property because droplets from the virus from infected people settled on surfaces, requiring continual cleaning.

“They had to permit people who were infected to repeatedly come in,” Murray Fogler, an attorney with Fogler, Brar, O’Neil & Gray who represented the medical college, said in a Houston Chronicle report. “That means we could not just wipe the surfaces clean and then we were OK.”

By maintaining its operations, in other words, the virus kept returning, making it clear it was something that was preventing its property from being used in the way it was intended.

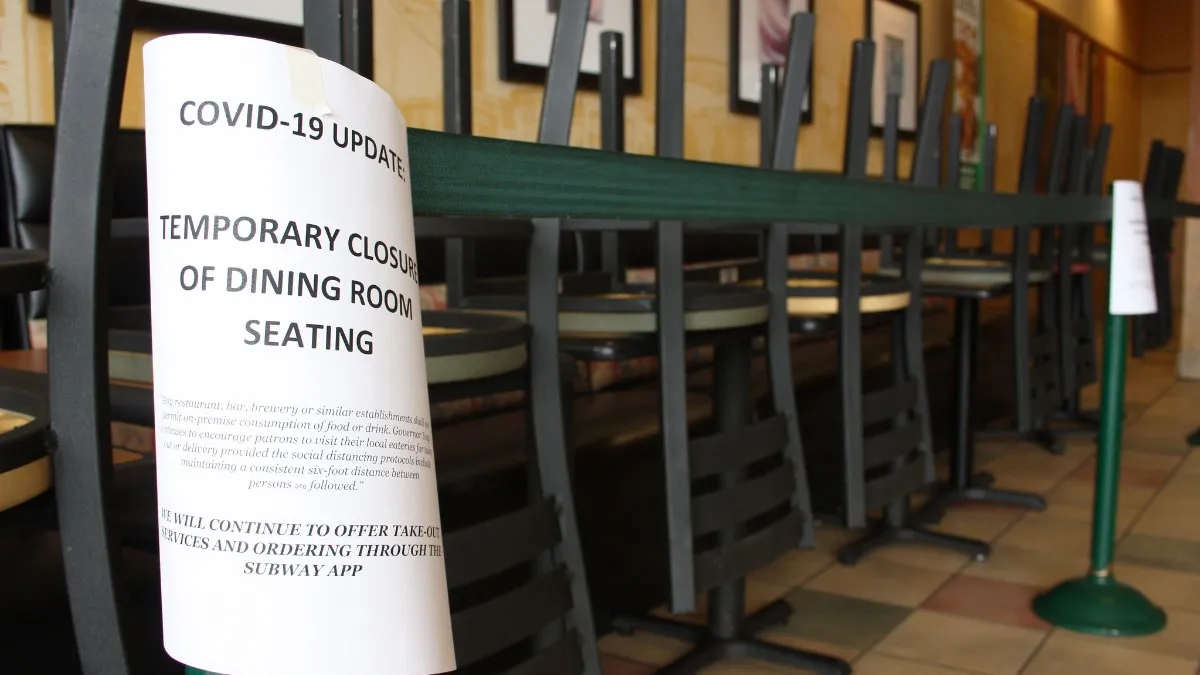

“We were able to prove the virus was there, which made us different than restaurants or hair salons or any other,” Fogler said, “because the property was repeatedly re-infected with the virus every day.”

How much these facts will influence other cases isn’t clear, although to the extent other cases go before a jury, the outcome could be favorable for plaintiffs.

“I’d hope that some of the courts would permit these [Covid insurance] claims to go to a jury in their jurisdictions,” Fogler said in a Bloomberg Law report. “It gives some hope to policyholders that it’s possible to win one of these claims. There are still many of them out there.”

Tough track record

Businesses have flooded insurers with lawsuits since the start of the pandemic for refusing to pay business interruption insurance but with little success. With a few exceptions, insurers have successfully argued that the coverage, which is typically part of companies’ property casualty insurance, requires loss of business due to property damage and not simply an interruption in a company’s income stream.

“These principles about having to have a physical loss or damage before you can ever get business interruption [have] been litigated and there is precedent for what that actually means,” Melinda Kollross, an attorney with Clausen Miller, has told Legal Dive. “The business interruption is the tail, not the dog. The dog is the loss or damage to the physical property.”

The Baylor case is the first in which a jury agreed with the plaintiffs that a virus can in fact cause property damage in a physical sense.

Baylor had taken out $100-million in all-risk policies with three insurers: XL Insurance America, ACE American Insurance and Lloyd’s.

Baylor has sued all three, but the two against XL and ACE were dismissed because their coverage excluded virus-related losses. The college has appealed.

Should the summary judgment in favor of XL and ACE be reversed now that the Lloyd’s ruling has gone the way it has, the insurers could be liable for a share of the college’s losses.

The school said it has sustained about $48 million in losses from the pandemic. Under last week’s jury verdict, Lloyd’s is to pay a quarter of that, or $12 million. The insurer is expected to appeal.

“Baylor was fortunate to have our case before a courageous judge who identified a fact issue that under our system of justice is decided by a jury,” Robert Corrigan, Baylor College of Medicine’s senior vice president and general counsel, said in a statement. “The Baylor community is deeply grateful to the jury for listening to the evidence and making an informed decision.”

The case was heard in the District Court of Harris County in Texas.